In today’s fast-paced world, credit scores play a crucial role in shaping our financial lives. Whether you’re looking to buy a car, rent an apartment, or apply for a credit card, having a strong credit history is essential. In South Africa, like in many other countries, credit scores are used by lenders to assess your creditworthiness and determine whether you’re a reliable borrower. In this article, we will explore what credit scores are, how they are calculated, and most importantly, how you can build a strong credit history to secure a stable financial future.

What Are Credit Scores?

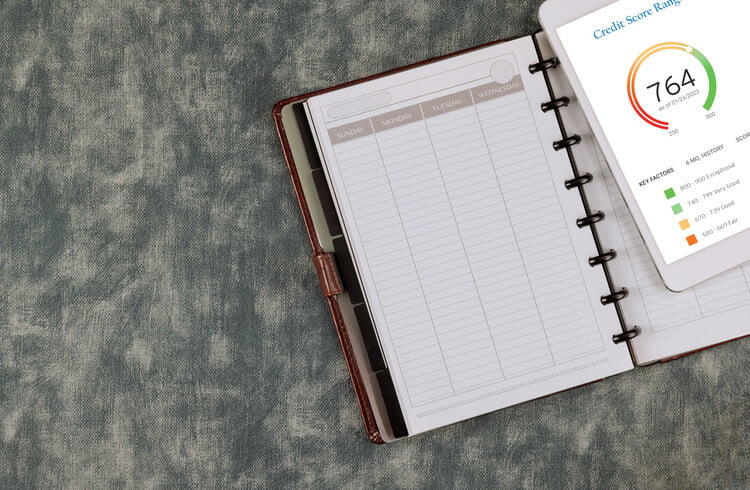

Credit scores are numerical representations of your creditworthiness. They are three-digit numbers ranging from 300 to 850 in South Africa, where a higher score indicates better creditworthiness.

Lenders use these scores to assess the risk of lending money to individuals. The credit score is a reflection of your credit behaviour and history, giving lenders insight into your ability to repay debts on time.

Understanding the Factors Affecting Credit Scores

Several factors contribute to the calculation of your credit score. Let’s delve into the key components that impact your creditworthiness:

- Payment History: Your payment history is one of the most critical factors affecting your credit score. Lenders want to see a track record of timely payments, including credit card bills, loans, and other debts. Consistently paying your dues on time can significantly boost your credit score.

- Credit Utilization: This factor refers to the percentage of your available credit that you are currently using. Lower credit utilization indicates responsible credit management and positively impacts your credit score.

- Length of Credit History: The length of your credit history also plays a role in determining your credit score. Generally, longer credit history with positive credit behaviour is viewed positively by lenders.

- Credit Mix: Having a diverse mix of credit types, such as credit cards, retail accounts, and loans, can improve your credit score. It demonstrates your ability to manage different forms of credit responsibly.

- Recent Credit Applications: Each time you apply for new credit, a hard inquiry is made on your credit report. Multiple recent credit applications can negatively impact your credit score, as it may indicate financial instability.

Building a Strong Credit History

Now that we understand the key factors affecting credit scores let’s explore some effective strategies to build and maintain a strong credit history:

Paying Bills on Time

One of the most effective and practical steps you can take to improve your credit score is to ensure that you pay your bills on time, every time. Your payment history carries significant weight in determining your creditworthiness, making it a critical factor that lenders consider when evaluating your credit application.

Late payments can hurt your credit score and may stay on your credit report for several years. On the other hand, consistently paying your bills by their due dates demonstrates responsible financial behaviour and reliability as a borrower. This can lead to an improvement in your credit score over time.

To make it easier to pay bills on time, consider setting up automatic payments or using reminders on your mobile phone or computer. You can schedule these reminders to alert you a few days before the due date, giving you enough time to arrange funds and make the payment promptly.

Let’s take the example of Mary, a young professional in South Africa, who wanted to improve her credit score to qualify for a better interest rate on a car loan. After reviewing her credit report, Mary noticed that a couple of late payments from a few months ago were negatively impacting her credit score.

To address this, Mary took practical steps to ensure on-time payments:

She set up automatic payments for her credit card bills and loan instalments. This way, the payments were deducted from her bank account on the due date, eliminating the risk of missing any payments.

Mary also marked her monthly bill due dates on her calendar and set reminders on her phone to pay bills that were not on auto-pay. These reminders prompted her to make timely payments even for bills that weren’t automatically deducted.

To ensure sufficient funds were available in her account, Mary created a budget and stuck to it. She allocated money for essential expenses, including bills and debt payments, right after receiving her paycheck.

In case of any financial emergencies or unexpected expenses, Mary built an emergency fund to avoid dipping into her allocated bill payment funds.

By taking these practical steps, Mary managed to consistently make on-time payments for several months. As a result, her credit score gradually improved, making her eligible for a more favourable interest rate on her car loan. This meant that she could now save money on her loan and also had the potential to access better credit card offers and other financial opportunities in the future.

Remember, improving your credit score is a journey that requires discipline and consistency. By focusing on practical actions, like paying bills on time, you can take control of your creditworthiness and set yourself up for a stronger financial future in South Africa.

Here are other key strategies to boost your credit score:

- Reduce Credit Card Balances: High credit card balances relative to your credit limits can harm your credit score. Aim to keep your credit card balances low and pay off outstanding balances as quickly as possible.

- Maintain a Mix of Credit: While it’s essential to avoid taking on excessive debt, having a mix of credit types can be beneficial. Consider having a credit card and responsibly managing a small personal loan or a retail account.

- Avoid Opening Multiple Accounts Simultaneously: Opening several new credit accounts in a short period can be seen as a red flag by lenders. It may indicate financial distress and potentially lower your credit score.

- Regularly Check Your Credit Report: Obtain a free credit report annually from credit bureaus like TransUnion or Experian. Review it for inaccuracies, incorrect information, or potential signs of identity theft. Promptly report any errors you find.

- Keep Old Accounts Open: Closing old credit accounts can negatively impact your credit history. If you have older accounts with a positive payment history, keep them open, even if you no longer use them frequently.

- Limit Credit Applications: Be cautious when applying for new credit. Submit applications only when necessary, as multiple hard inquiries in a short period can temporarily lower your credit score.

Securing Your Financial Future Through Strong Credit Management

Credit scores are a crucial aspect of personal finance in South Africa. They not only influence your ability to borrow money but also affect the terms and interest rates you may be offered by lenders. Building and maintaining a strong credit history is within your control and is an essential step toward achieving financial stability.

By paying bills on time, keeping credit utilization low, and maintaining a mix of credit types, you can steadily improve your credit score. Additionally, regularly checking your credit report for inaccuracies and being cautious about credit applications will help you stay on track.

Remember that building a strong credit history takes time and consistent effort, but the benefits of having a solid credit score are well worth it. With a positive credit history, you can confidently navigate the world of credit and secure a brighter financial future for yourself.