Managing personal finance is a key factor in achieving financial freedom, and that can be achieved through a budgeting plan.

Financial freedom means having enough savings and investments that can cover all your expenses, allowing you to pursue your passions without worrying about money.

However, it is not easy to achieve financial freedom. You need to have a clear understanding of your income, expenses, debts and savings. Hence, the most crucial part of achieving financial freedom is creating a budgeting plan.

What is a Budgeting Plan?

A budgeting plan is a detailed overview of your income and expenses over a specific period. It helps you track your expenses, ensuring you spend less than you earn.

A budgeting plan helps you find areas where you can cut back to save money and invest in your future.

Step-by-Step Guide to Creating a Budget

1. Determine your Income

The first step towards creating a budgeting plan is to determine your income. Your income includes all the money you receive, such as your salary, freelance work, or rental income. If you have a variable income, use the average amount received every month for your budgeting plan.

2. Track your Expenses

After determining your income, track your expenses for a month. Write down all your expenses, from monthly bills to grocery shopping. This will help you identify areas where you are overspending and where you can cut back.

3. Categorize your Expenses

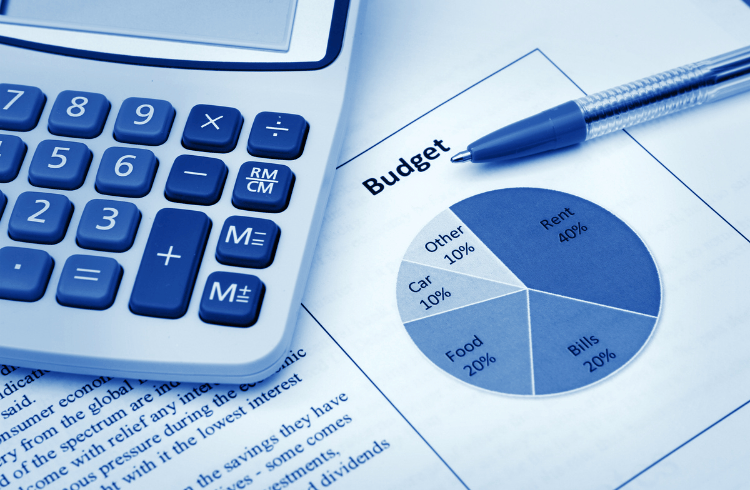

Categorize your expenses as essential and non-essential. Essential expenses include rent/home loan repayments, groceries, utilities, and transportation. Non-essential expenses include dining out, entertainment, hobbies, and subscription services.

4. Create a Budget Plan

Using the data you collected in Steps 1-3, create a budget. Start by deducting your expenses from your income. If your expenses are more than your income, you need to reconsider your expenses, especially non-essential expenses. Make sure you allocate your income towards your savings or investment accounts to achieve financial freedom.

5. Review and Adjust the Plan

Creating a budget is not a one-time process. You need to review your plan regularly, make adjustments and track your progress. Revisit your budgeting plan at the beginning of each month to ensure everything is in place.

Implement Budget Plan Tips

To get the most out of your budgeting plan, you need to implement the following tips:

- Start Small: Begin with a smaller period, such as a month, to help you adjust.

- Use Digital Tools: There are several digital tools such as Google Sheets, Excel, or Mint, that can help you create a budgeting plan and track your expenses.

- Support System: It helps to have a support system or a financial advisor to guide you through the process.

By creating and sticking to a budget plan, you can achieve financial freedom, no matter your income level.

The Key to Financial Freedom

A budgeting plan is the key to achieving financial freedom. By creating a clear and detailed budgeting plan, you can track your finances and ensure you spend less than you earn.

You can find ways to save money and invest in your future. The journey to financial freedom might be overwhelming, but with a budgeting plan, you are one step closer to a stress-free life.